A Financial Mentor Can Guide You On Your Journey to Financial Independence

By Ken Kozloff

Britepaths and Financial Empowerment Center at South County Volunteer

Are you stressed out about money and having trouble meeting all your expenses each month? Working with a Britepaths volunteer Financial Mentor might be for you.

Britepaths offers FREE and confidential help to adults in Northern Virginia or the Washington, DC metropolitan area who work a minimum of 30 hours per week and meet other requirements.

Your Mentor will be your guide while you identify your personal finance priorities and develop a personalized plan to tackle them. These might include:

- How to stop living paycheck-to-paycheck

- How to build your savings by “paying yourself” first

- How to prioritize paying your bills

- How to get out of debt

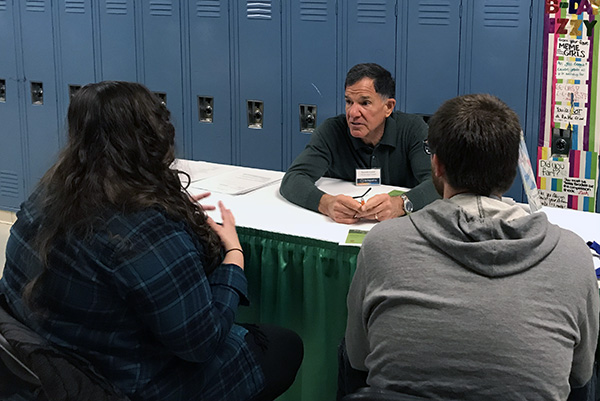

With the help of a Financial Mentor, you will have a minimum of two free coaching sessions per month to review and discuss your individual financial situation. All information is held totally confidential and is not shared with outside sources. Britepaths’ Mentors are trained volunteers who often have backgrounds or interest in personal finance. They do not suggest or sell financial products or services to their mentees.

A Mentor Perspective

I have been a Financial Coach and Mentor for over nine years and have had many clients successfully complete the program. As a Mentor, it has been my experience that those clients who are motivated, attend the two minimum required meetings per month, whether virtually or in person, and honestly represent their financial situations are successful in completing their goals.

Client Impact Story

Perhaps my best client success story concerned a single mom who had a high school student ready to start college. My client was underemployed, needed a working resume, did not have a budget or savings, and usually paid her bills late. After working together for a year, she was able to obtain a better job with a $20,000 salary increase, redo her resume, improve her interviewing skills, develop a working budget and savings program, and pay her bills on time. With financial assistance, she was able to contribute money to her son’s college education.

Get Started

Are you interested in learning more? The first step is to schedule a free one-on-one virtual Financial Coaching session through the Financial Empowerment Center at South County (FECSoCo), where a Coach can help you assess your financial situation. You might meet a few times.

Click Here to Get Started

Questions? Contact Carole Rogers at 703.273.8829 or contact us.

Ken Kozloff has served as a volunteer Financial Coach and Mentor for more than nine years.