Paola’s Story

Congratulations to Paola, who graduated from our Project BRIDGE Program (now Workforce Development) on May 26, 2016! Paola is a single mother of six who lives in Fairfax County. When she started Project BRIDGE in 2015, she had been working for the same company for 15 years. It’s a good administrative position with medical benefits and a 401k plan, but Paola had fallen behind on many of her bills. Her older sons, who work and go to school part-time, were able to help some with the bills, but she knew she needed to find a way to get on top of her finances.

She was referred to Britepaths from the County’s Family Self-Sufficiency Program, which she volunteered to participate in. This is a 5-year program offered to high-achieving residents who are motivated to move off of housing assistance and into homeownership. Paola was extremely motivated and said she came to us for “assistance with creating a budget that I will maintain and setting goals so that I will be able to buy a home.” She was very concerned about her low credit score. Her goals upon entering the Program included raising her credit score, paying off an auto loan of $5,100, paying off credit cards, getting up-to-date on her utility bills, organizing bills and learning how to make and maintain a budget. Her personal goals included completing the math and English placement at Northern Virginia Community College (NOVA), requalifying for the Homebuyer’s program, and saving enough to take a trip to her home country to visit family that she had not seen for years.

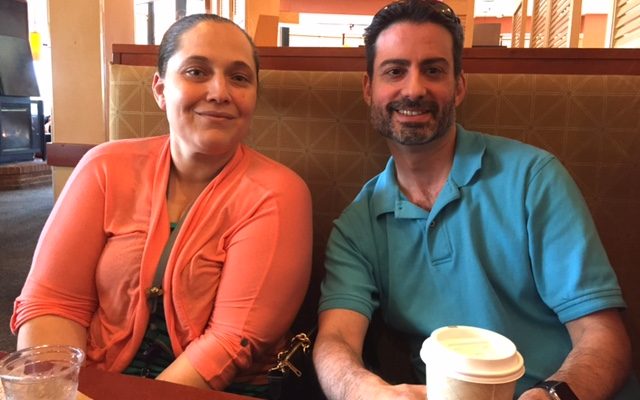

Paola was matched with Greg, an experienced volunteer Financial Mentor, and they began working together to fill in a budget template to help identify weaknesses to tackle in the coming year. Greg noticed her water bills were exceptionally high. It turned out there was a leaky pipe in her home, and although she was not issued any credits, she was able to repair the leak and negotiate with her landlord to receive some reimbursement. Examining store credit balances, Greg explained interest rates and why it is crucial to pay off her store bills. Into her budget went monthly payments to pay off those cards, as well as a much-needed plan to catch up on her utility bills. Shortly after beginning her work with Greg, Paola received a reimbursement check from her car manufacturer for a major engine repair that was done earlier in the year. That check helped to greatly reduce her auto loan and significantly moved up the date she would own her minivan. After a few months of working together, Greg suggested that Paola could save for her trip by enrolling in our Matched Savings Program. The program asks clients to make monthly deposits into a savings account for a year, and Britepaths matches the savings up to $500.

Greg encouraged Paola to really scrutinize her discretionary spending, and she quickly found that this was an area in which she could cut a significant amount of expenses. She hadn’t realized the effect that going out for dinner had on her budget. Over time, she made concerted efforts to take her lunch to work, plan ahead for meals and cook more at home. Paola attended our Life Skills Workshops, and the Healthy Eating Workshop run by local nutritionist Elana Natker really resonated with her. She was able to take away great information that simplified the concept of eating healthy for her. Paola has lost weight and continues to eat right. Other workshops that Paola attended and learned from were, Preparing Your Own Income Taxes and Career Exploration and Skills Assessments. Both workshops enabled her to look at her own situation and perform the tasks needed to help herself and her family move forward.

Paola also encountered unforeseen difficulties over the year. She lost some loved ones, had some family issues, and encountered some unexpected expenses. But she kept her eyes on her financial goals, remained focused and persevered. She is showing her children that in good and bad times, maintaining financial responsibility and stability is crucial. Working with Greg, she was able to achieve her financial goals and is now in a great position to apply for the first-time Homebuyer’s Program, which she is eager to do. The setbacks she encountered did delay her from taking the entrance tests to NOVA, but returning to school is still a goal of Paola’s that we are certain she’ll achieve. And, through the Matched Savings Program, she has the beginnings of a solid savings that she can apply toward her trip home.